If you're on the look-out for a pre-owned luxury vehicle, you might be more willing to extend your search beyond your local area to make the most of the differences in regional markets. That’s why we’ve conducted some research to find the UK’s hotspots for those looking to invest in second-hand luxury cars.

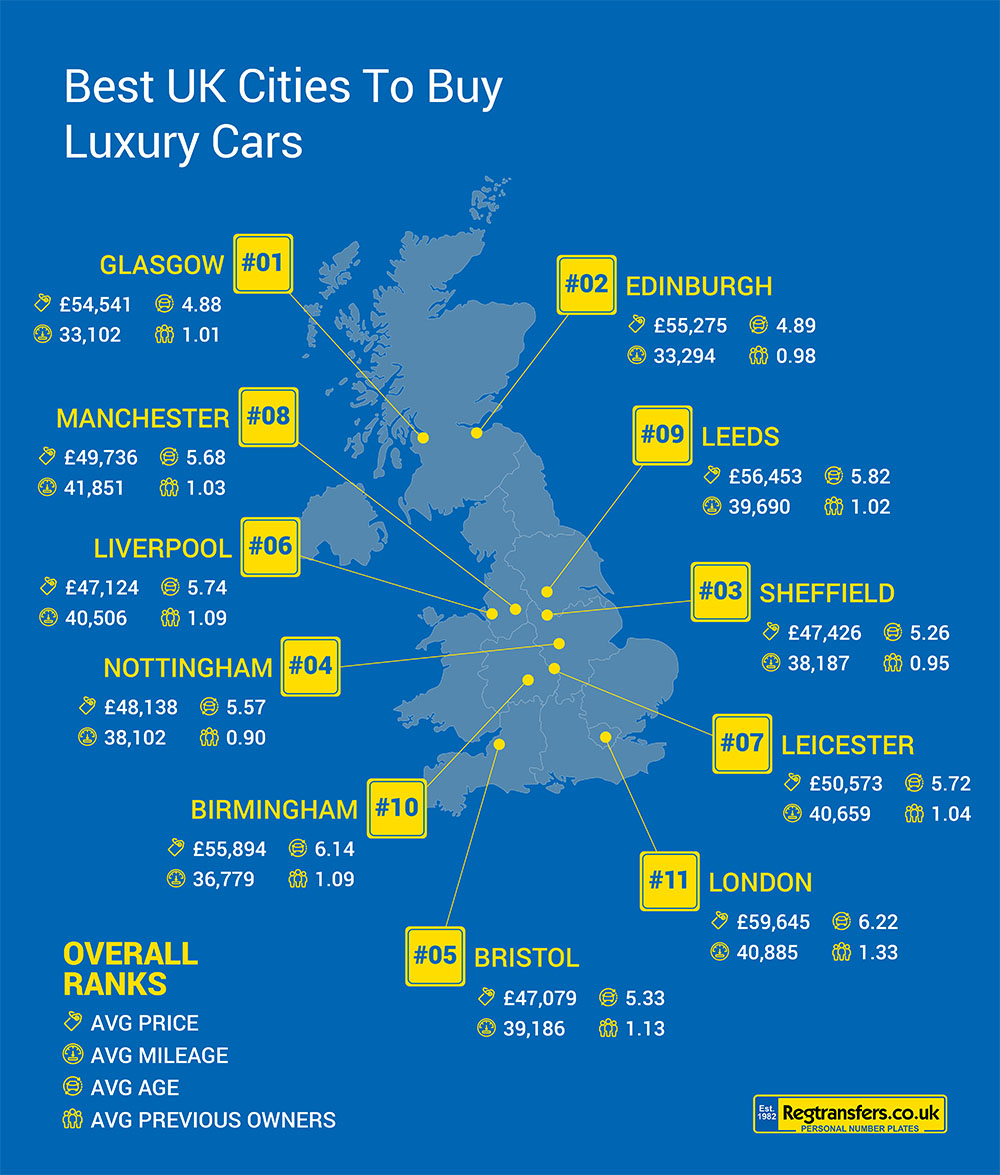

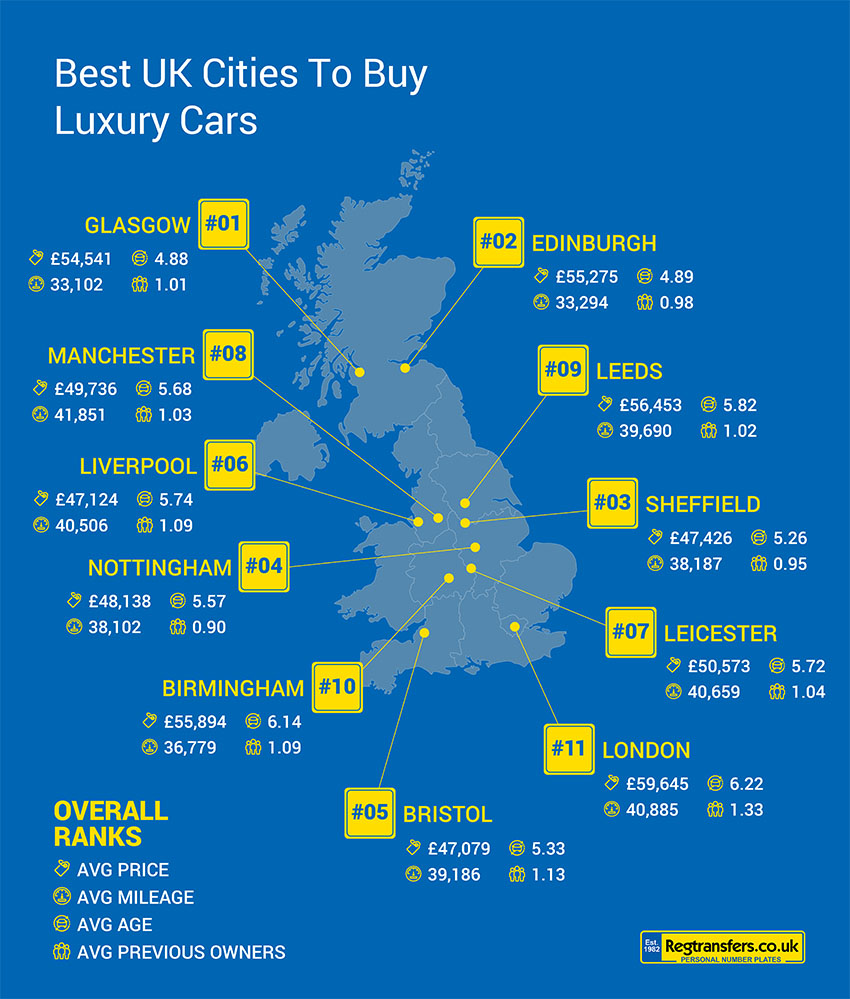

In a surprising twist, the cities of Glasgow and Edinburgh have been named the unexpected leaders for those looking to invest in pre-owned high-end vehicles. This revelation comes amid a broader analysis of the luxury automotive market across the UK, where expectant front-runners like London have surprisingly fallen short in terms of value for buyers.

Unveiling Scotland's pole position

We analysed the details of over 25,000 online luxury car listings, in order to identify the “hotspots” in which UK buyers can find the perfect “buyer’s blend” - competitive pricing, low mileage and fewer previous owners.

Our research spanned a 20-mile radius of London and other major UK cities, focusing on high-end models from illustrious brands such as Porsche, Lamborghini, Tesla, and Rolls-Royce. The findings placed Glasgow and Edinburgh at the top, thanks to their ideal mix of competitive factors considered crucial by potential buyers.

Digging deeper into the numbers

Across the UK, the average price for these luxury vehicles stands at £52,452, with an average mileage of 39,211 and an age of around 5.6 years. Interestingly, while these cars are expected to have lower road use, the study presented an anomaly, especially in London, known for its driving constraints.

However, it's not just about the pricing. As Regtransfers CEO Mark Trimbee points out:

Exceptionally low prices can often be a red flag, signalling lower quality or hidden costs. True value isn't just in the initial cost; it's in the vehicle's history, condition, and longevity.

This insight is particularly relevant when we see that, despite having the 7th highest prices, Glasgow leads in offering newer models with fewer previous owners and lower mileage.

Conversely, London, with the highest average prices, ranks as the least competitive market. The capital's vehicles are generally older, with more miles and more previous owners, thus diminishing their appeal despite the city's economic clout.

The 'nearly-new' market dynamics

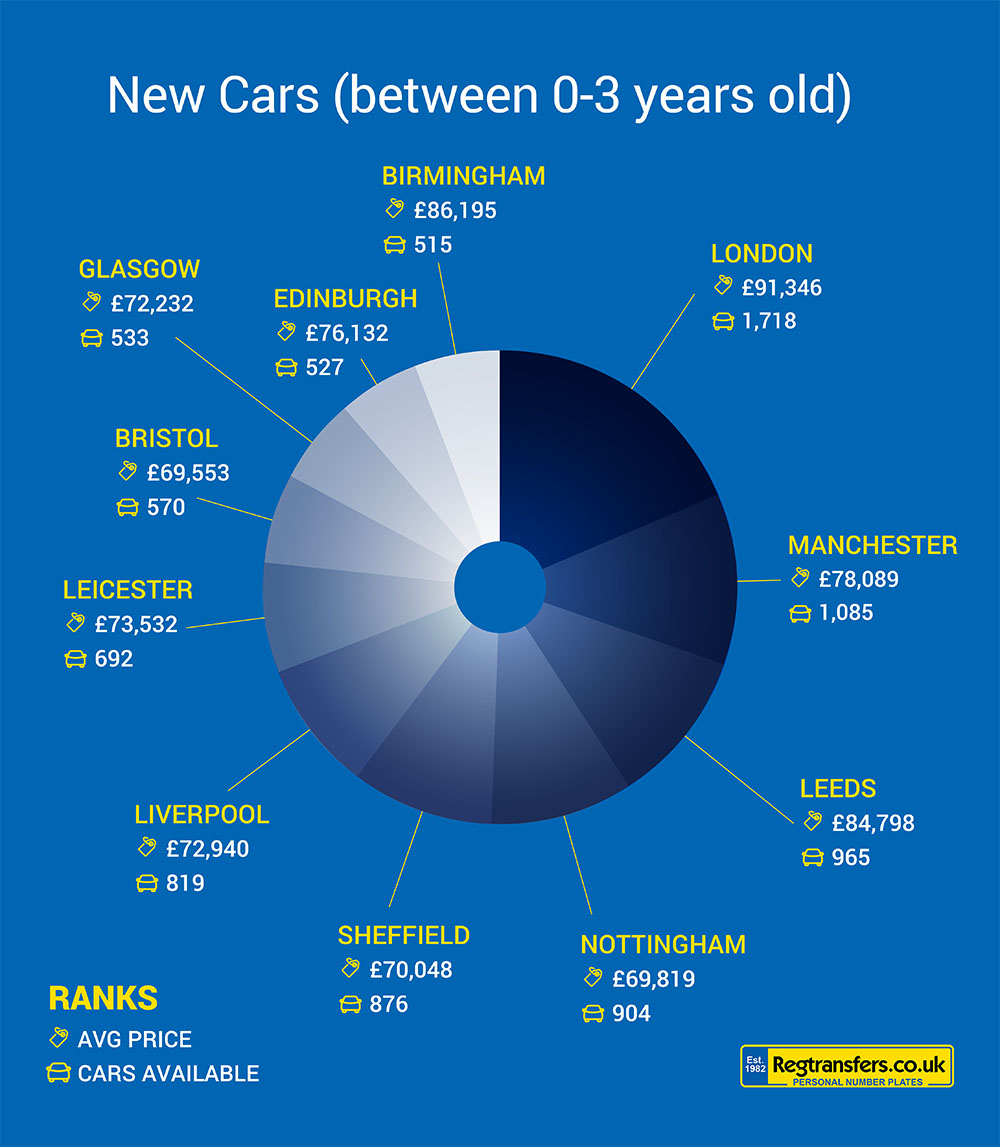

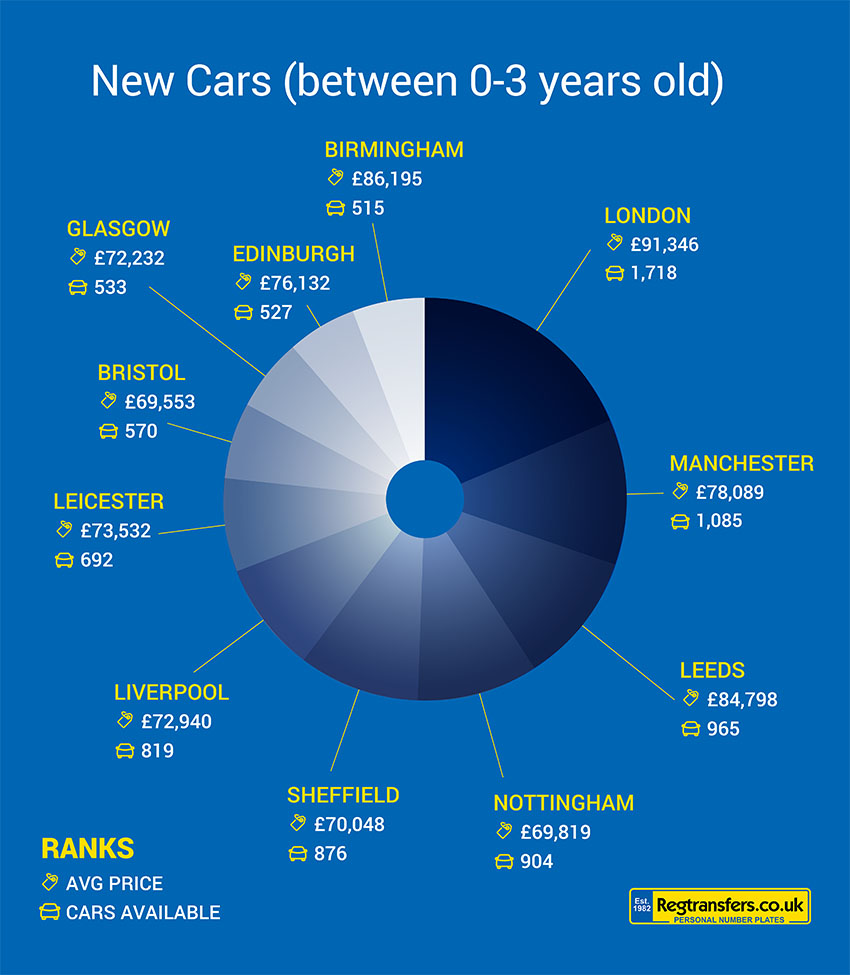

While the research sheds light on the thriving market for second-hand luxury vehicles, it also explores the 'nearly-new' segment of the market, encompassing vehicles closest to the latest offerings that are between 0-3 years old. This sector caters to buyers seeking newer models with minimal prior ownership, offering a balance between luxury and cost-effectiveness.

Though prices soar for these newer models, especially in cities like London and Birmingham, availability is equally high. Once again, Bristol tops the list as the cheapest region to buy a newer model, but they are in higher demand; the sample market contained only 570 listings within a 20 mile radius of the city centre.

Most popular models

When it comes to the most popular luxury models within each analysed brand, familiar names such as the Aston Martin Vantage, Bentley Continental, Lotus Emira and Porsche 911 show clear dominance in their respective brand spaces, accounting for a third or more of the listings that were analysed. Brands like Maserati, Lamborghini and Dodge proved a little rarer across the UK, with fewer listings appearing in the data.

| Make | Avg Price | Model | Avg Price | Count | Weight(%) |

|---|---|---|---|---|---|

| Aston Martin | £104k | Vantage | £84k | 290 | 34.81 |

| Audi | £56k | RS3 | £41k | 341 | 31.72 |

| Bentley | £106k | Continental | £76k | 458 | 40.03 |

| BMW | £41k | 7 Series | £29k | 321 | 48.86 |

| Dodge | £61k | Challenger | £72k | 13 | 52 |

| Genesis | £43k | G70 | £31k | 267 | 56.93 |

| Jaguar | £24k | F-pace | £30k | 1,124 | 26.09 |

| Lamborghini | £217k | Urus | £223k | 142 | 46.86 |

| Land Rover | £38k | Range Rover Evoque | £22k | 3,796 | 37.78 |

| Lotus | £60k | Emira | £80k | 76 | 46.34 |

| Maserati | £48k | Levante | £50k | 157 | 38.86 |

| McLaren | £157k | GT | £132k | 43 | 15.25 |

| Mercedes-Benz | £92k | S Class | £48k | 453 | 37.07 |

| Polestar | £37k | 2 | £37k | 316 | 97.53 |

| Porsche | £61k | 911 | £87k | 1,303 | 35.46 |

| Rolls-Royce | £211k | Cullinan | £327k | 56 | 26.42 |

| Tesla | £33k | 3 | £29k | 1,038 | 75.33 |

In particular, electric vehicles such as the Tesla Model 3 and Polestar 2 stand out in the chart above. The Tesla Model 3 accounts for two thirds of all Tesla cars from the sample market data, while the Polestar 2 has almost 100% of the market share. With electric cars being relatively new to the luxury car market - and with fewer models by comparison with long-standing giants like Porsche or Bentley - this is not too surprising to see.

Trimbee reflects on these findings, stating:

One could argue the case of fewer listings indicating a sense of rarity and, therefore, greater popularity. However, popular cars among enthusiasts, like the Porsche 911, are available in abundance.

Navigating the luxury market in trying times

The findings of this research come at a time when economic challenges are impacting household decisions. Trimbee emphasises the importance of informed decisions, stating:

It’s critical to conduct thorough research to ensure you’re getting the best value for your money. Keeping track of market trends is also vital for those planning to sell, ensuring they do so at the right time for maximum return on investment.

Whether you're a potential buyer or a seller, understanding these market dynamics is key to making optimal decisions, ensuring that investments in luxury are just as much about intelligence as they are about indulgence.